Little Known Facts About Hsmb Advisory Llc.

Table of ContentsNot known Details About Hsmb Advisory Llc Fascination About Hsmb Advisory LlcThe Definitive Guide for Hsmb Advisory LlcThe Only Guide for Hsmb Advisory LlcUnknown Facts About Hsmb Advisory LlcNot known Details About Hsmb Advisory Llc Our Hsmb Advisory Llc Statements

Also understand that some plans can be pricey, and having specific wellness problems when you apply can increase the costs you're asked to pay. Health Insurance. You will certainly require to ensure that you can manage the premiums as you will need to devote to making these settlements if you desire your life cover to remain in locationIf you really feel life insurance might be valuable for you, our partnership with LifeSearch allows you to obtain a quote from a number of service providers in double quick time. There are various sorts of life insurance policy that intend to satisfy different security requirements, including level term, decreasing term and joint life cover.

Our Hsmb Advisory Llc Diaries

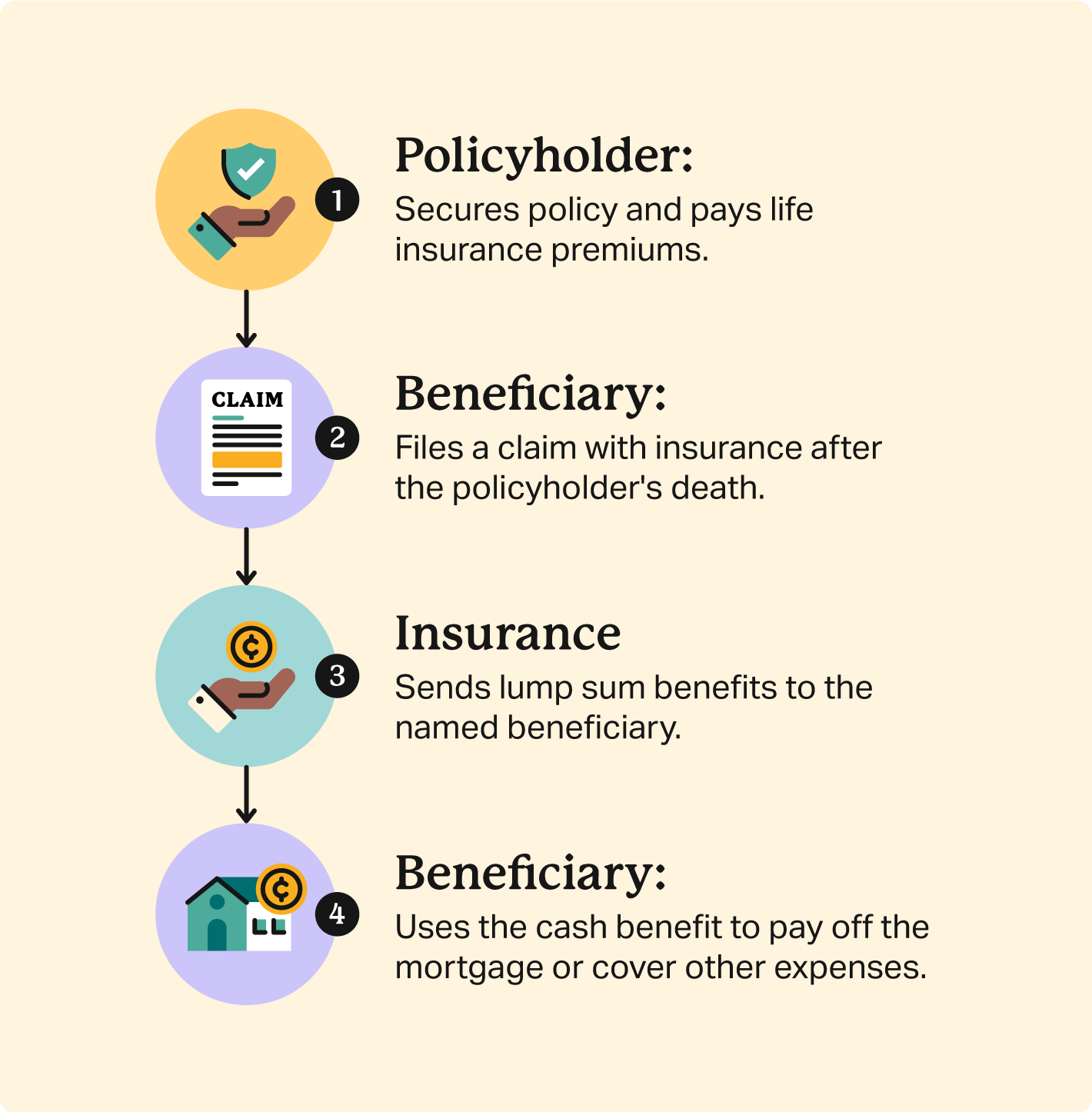

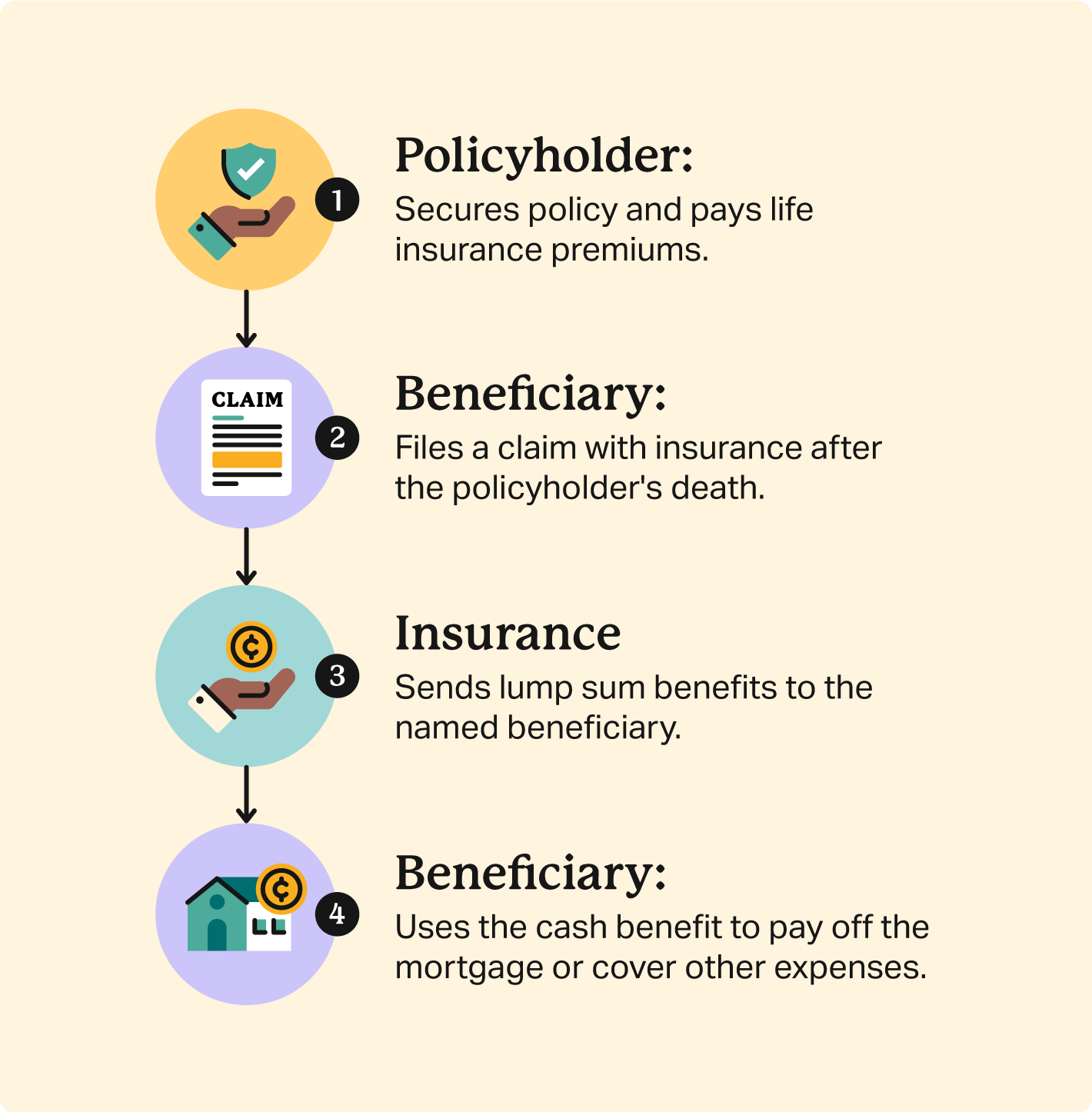

Life insurance policy offers five financial advantages for you and your family members (St Petersburg, FL Health Insurance). The major advantage of including life insurance to your economic plan is that if you pass away, your heirs get a round figure, tax-free payment from the policy. They can utilize this money to pay your last costs and to change your earnings

Some policies pay out if you create a chronic/terminal ailment and some offer savings you can use to sustain your retirement. In this post, learn regarding the various advantages of life insurance policy and why it may be a great idea to spend in it. Life insurance coverage supplies benefits while you're still active and when you die.

Everything about Hsmb Advisory Llc

If you have a policy (or plans) of that size, individuals that depend upon your revenue will still have cash to cover their ongoing living expenditures. Beneficiaries can make use of policy benefits to cover essential everyday expenditures like lease or home mortgage repayments, energy bills, and groceries. Ordinary yearly expenditures for families in 2022 were $72,967, according to the Bureau of Labor Data.

The Basic Principles Of Hsmb Advisory Llc

Development is not affected by market problems, permitting the funds to gather at a secure price with time. Additionally, the cash worth of entire life insurance policy expands tax-deferred. This suggests there are no revenue tax obligations built up on the money value (or its development) until it is taken out. As the money worth develops up in time, you can use it to cover expenses, such as buying an automobile or making a deposit on a home.

If you choose to obtain versus your cash worth, the finance is not subject to income tax obligation as long as the plan is not given up. The insurance coverage business, however, will bill passion on the finance quantity until you This Site pay it back (https://disqus.com/by/disqus_oYa1ZrRcOR/about/). Insurance provider have varying passion prices on these finances

Not known Details About Hsmb Advisory Llc

8 out of 10 Millennials overestimated the cost of life insurance in a 2022 research study. In reality, the average cost is closer to $200 a year. If you believe buying life insurance policy may be a smart financial action for you and your household, think about seeking advice from a financial expert to adopt it right into your monetary plan.

The five main sorts of life insurance policy are term life, entire life, universal life, variable life, and last expenditure protection, likewise called burial insurance. Each type has various attributes and advantages. As an example, term is much more economical yet has an expiration day. Whole life starts costing much more, yet can last your entire life if you keep paying the costs.

About Hsmb Advisory Llc

It can repay your financial obligations and clinical bills. Life insurance could additionally cover your home mortgage and offer money for your family members to keep paying their bills. If you have household relying on your revenue, you likely need life insurance policy to sustain them after you pass away. Stay-at-home moms and dads and service owners likewise often need life insurance policy.

For the most part, there are two kinds of life insurance policy plans - either term or permanent plans or some combination of the 2. Life insurers offer various forms of term strategies and traditional life plans along with "passion delicate" products which have actually come to be extra common because the 1980's.

Term insurance policy offers protection for a specific amount of time. This duration could be as brief as one year or give insurance coverage for a details number of years such as 5, 10, 20 years or to a defined age such as 80 or in some instances approximately the oldest age in the life insurance policy mortality.

Some Known Factual Statements About Hsmb Advisory Llc

Presently term insurance prices are really competitive and among the lowest historically seasoned. It ought to be kept in mind that it is a widely held belief that term insurance policy is the least expensive pure life insurance policy protection available. One needs to assess the policy terms thoroughly to determine which term life options appropriate to satisfy your certain situations.

With each new term the costs is raised. The right to renew the policy without evidence of insurability is an essential benefit to you. Or else, the threat you take is that your health may weaken and you might be incapable to get a plan at the same rates or perhaps whatsoever, leaving you and your recipients without protection.